Luxury retail trends emerging in 2018

Market analysis shows the future scenarios of the luxury sector, highlighting the growth of luxury on a worldwide scale. At the same time for the future they call attention to the online sales that are becoming increasingly dominant.

For retail, the most important challenge will be to find the perfect synergy between the online and offline channel.

An overlook of the luxury retail trends:

1. What does luxury mean?

2. The luxury retail sector in figures: market characteristics and main trends

3. Luxury: future trends

4. Which luxury trends will drive the store?

1.What does luxury mean?

Before we find out which luxury retail trends are emerging in 2018, let's try to define what luxury is and what we mean when we use this word. Would you be able to give a clear and unambiguous definition to this term?

Probably not: some might answer that we refer to "handmade products and made with precious fabrics or materials", someone else could define luxury as "an emotion, the feeling you feel after having lived a luxury experience"; others still would say that "luxury is the ability to buy what you want when you want" or, for many others, "the real luxury nowadays is time”?

As we can understand, this term admits more interpretations: it can refer to goods belonging to completely different merchandise characteristics and is closely linked to the psychological and emotional dimension of the consumer.

Indeed, if we think about it, it is a multidimensional and relative concept:

- With respect to the place where you live

- With respect to economic possibilities

- With respect to time

The luxury goods

Even if the term luxury does not express something universal, we can still identify elements that most people would recognize and classify as luxury goods.

They are characterized by two components, one of a functional type, which identifies the characteristics of the products, and one of an emotional type, which has to do with aspects of personality and perception.

The functional characteristics of luxury products

• High price: can be defined as high absolute or in relative terms, compared to products that perform the same function and is legitimized by the high quality perceived and by the idea of durability connected to it.

• Excellent quality: it derives from the singularity of the raw materials used (eg diamonds) and from the care of the creation processes (craftsmanship, Made in, etc), hours of work used to make the product.

• Rarity: the greater the inaccessibility and the perceived scarcity of the product, the greater the desire it raises in consumers.

• Outstandingness: the ability of products to amaze consumers thanks to their spectacular and exclusive features and details.

• Aesthetics: understood as an objective beauty that captures and makes people dream and is made up of a mix of design elements and unique details, capable of involving all the senses (sight, smell, touch, and taste).

• Symbolism: a set of abstract associations whose purpose is not to satisfy a need but rather to make people daydream.

Given that the functional components are equivalent and present in all luxury products, for brands, to be able to significantly differentiate themselves from competitors, they should focus on the symbolic and emotional aspects that make up the personality of the brand and its products, in order to create a strong and authentic identity, on which the perceptions that consumers have of them will depend.

Now let's analyze the characteristics of the luxury market.

2. Luxury Retail: market characteristics and main trends

"Luxury will be more casual, fun, contaminated by collaborations and mixed to premium, fast fashion and research proposals". This is what emerged from the "Altagamma consumer and retail insight 2018" conference, held in Milan, during which the fifth edition of the "True luxury global consumer insights" by Altagamma and Boston Consulting group (Bcg) was presented.

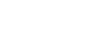

The luxury market continues to grow: in 2017 it reached 915 billion euros, + 6% on 2016, and is ready to reach 1.3 billion in 2024. Twelve thousand interviews were carried out in 10 markets around the world to consumers who spend an average of € 27,000 a year on luxury (we are talking about recurrent consumption, which therefore excludes goods such as cars and boats).

Let's have a look together the trends in luxury retail emerged in 2018:

- The average annual expense in luxury products is 37,000 euros in 10 countries (among which we find China, USA, Italy, France, Japan, Korea and Brazil).

- Purchases of luxury products are concentrated in the highest segment of the market: 18 million individuals - equal to 4% of the 424 million luxury consumers - absorb 30% of the market in value.

- There are currently two drivers (as explained by Nicola Pianon, senior partner and managing director of Bcg): the Chinese and Millennials are those who drive the growth of luxury and their weight is bound to increase considerably. The 20-35 year-olds today in fact absorb 30% of the luxury market, but will reach 50% in 2024. While the Chinese will come to weigh 40% in the next six years, contributing to growth for about 70%.

- The consumer with the highest potential, in fact, is the Chinese under 35, who lives in a big city or rich young people who live in big cities in the world ("megacitier") or wealthy young people from emerging countries approaching luxury for the first time ("rich upstarter"). Or, again, a "fashionista" who inspires others through Instagram.

- The growth of luxury will mainly concern the experiential segment, which today is worth € 585 billion and will reach € 850 billion in 2024 and it should grow faster than personal luxury. In the latter category, perfumes, cosmetics and accessories will be the categories with the highest growth rate.

- Luxury shoppers reconfirm themselves as admirers of quality and craftsmanship but ask for something more to differentiate themselves, through extravagant and fun proposals.

- Made in Italy remains at the top of consumer preferences, but the USA is growing, thanks to its ability to do marketing and build brand value. On the other hand, China, although it is considered the world's factory, is not yet "brand factory for the world".

- Luxury consumers appreciate brand partnerships with characters from the arts and music worlds and continue to mix luxury with fast fashion, premium and niche brands, even those that are little known.

They also remain faithful to the brands they buy if the latter offer products that meet their needs. Social media influence consumers more than traditional media because they are perceived to be more authentic.

What is impossible to ignore are the changes related to the Internet that have modified the commercial and communication strategies. In 2024 the online channel should represent over 15% of the luxury market and already today, those who buy online, do so in 55% of cases via smartphone.

As online sales are becoming more and more prevalent, the most important challenge for retail is to find the perfect synergy between online and offline and to choose the right channels sell through the Web.

3. Future trends in luxury: the combination of store and digital

We have seen that the Fashion & Luxury market is constantly growing thanks to the digital strategies put in place by the big luxury brands to attract a younger audience. Instagram has proved crucial in this path of rejuvenation of the market.

Louis Vuitton is reconfirmed leader of the most valuable brands in the sector, but the big news in the ranking of Luxury professionals of this 2018 is the growth of Gucci which increases by 66%, thanks to Asian millennials, and reaches 22.4 billion dollars (over 19 billion euros).

"Disillusioned by the events of the world, consumers seek stimulation, happiness, they want to escape through luxury, helped by digital platforms, such as Instagram and other social channels, on which the Luxury sector has relied to unveil its latest collections and attract the younger ones. "

This is what the report of the new edition "BrandZ Top 100 Most Valuable Global Brands" shows from which it emerges that companies like Hermès, Burberry and Gucci have embraced digital technologies, once feared by luxury brands for fear of reducing their prestige and exclusivity, thus attracting the younger segments and offering unique and continuous shopping experiences through multiple channels.

The weight of e-commerce in the luxury sector

Nowadays companies, if they want to continue to grow, must increasingly consider digital, not only as an integral part of their communication strategy but at every stage of the process: from supply, to production, to get to the management mechanisms in -store.

This is what emerges from another recent research developed by McKinsey, highlighting a further element considered fundamental for each company, e-commerce. It’s in continuous growth, in 2016 it reached 8% of the total luxury goods market, which amounts to 20 billion euros in turnover, out of a total of around 250 billion. While 2017 globally closed up 5% on the previous year out of a total of 262 billion.

The same analysis states that this percentage will only increase, to reach 20% in 2025. This is because offline purchases are increasingly digital-influenced: it is important to implement a strategy that provides consistency between online and offline sales.

Still in the luxury and digital market, another great transformation that is taking place is represented by mobile devices. 98% of consumers in the luxury market have a mobile device and, next year, the time spent browsing through the smartphone will be four times higher than that spent on desktops.

4. What will the trends be in the 2018 luxury retail that will drive the store?

The priority of retailers today is to integrate the physical channel and the digital channel for a complete shopping experience, building a strategy based on omnichannel.

The omnichannel approach is becoming more and more evident: on average 3 out of 4 consumers expect that a brand can be reached through different channels, in China even 9 out of 10.

Although the protagonist seems to be digital, the sales point does not disappear and does not have to do so since the physical store is essential to create bonds and build human relationships with its customers.

In the future, the great challenge is to offer a full, satisfying experience, where the purchase remains memorable.

All this can happen thanks to digital innovation along with the most advanced technologies, but this road still seems to be all uphill, especially for small-medium retailers who are not yet ready to invest in digital technology, both for the lack of information and adequate skills, and for its high costs and uncertain returns. However, the market and technological advancement require the retailer to show the courage and foresight to project the stores to the future, in order to satisfy increasingly demanding and digital customers.

Still remaining in the digital field the Word of Mouth on Social Media and Blog, is one of the main levers of influence in the sector and its weight is constantly growing.

While a further value to which the luxury brands are aiming more and more is social and environmental sustainability: in fact, companies will have to work with a view to ethics, social and environmental respect, along with entire value chain.

The luxury market and augmented reality

Augmented reality that enhances the luxury retail experience and shopping experience, integrating with physical stores.

The new technology can allow consumers to view and "try" new products at home before making a purchase.

For example, DeBeers launched its "Forevermark Fitting" app, which allows consumers to try out their jewels collections’ through their webcam and to see how they look like with certain lights and certain skin tones; so they will be able to select those that best suit their needs.

An example of the future of luxury online

In April last year the luxury online retailer Farfetch announced, a new digital 3.0 platform called "Store of the Future", whereby the digital world increasingly blends with physical retail in a vision of omnichannel.

José Neves, co-chairman and CEO of the platform, explained:

"Retailers need to gather information about their customers just like they do online. The Store of the future will therefore be the link between an excellent online presence and a complete omnichannel offer, with its own technology, which improves the on-site consumer experience and allows the retailer full visibility of what happens in the store. The next step in the evolution of the fashion industry is the connected store, which uses technology to emphasize the retail luxury experience to become even more customer-centric."

The new project "Store of the Future" presented in-store technology, which allows buyers in the luxury market to use their smartphone when they enter a store and receive personalized advice from the sales staff. The same staff would be able to access the profile of their most frequent customers and have information on their purchase history and product wish lists.

The use of these data will be useful to customize the shopping experience and that is to do what the marketing experts call "shop emotional experience", creating tailor-made technologies for each brand, city and store.

Farfetch has also announced a new partnership with Gucci: "Store to Door in 90 Minute's". This is a new service that provides the delivery directly to the buyer's home of Gucci designer bags and accessories, purchased on Farfetch, in just 90 minutes. The service, which is part of the "The Store of the Future" project, will be available in the cities of London, New York, Dubai, Los Angeles, Madrid, Miami, Milan, Paris, Sao Paulo and Tokyo.

Let the future of shopping begin!

previous news

previous news